Income tax primarily refers to the taxation of income from non self-employment, therefore, given its complexity and economic importance, this tax form is constantly exposed to reform changes with the aim of creating a fairer and more tolerable tax burden important not only for taxpayers but for the economic competitiveness of labor environment of the country.

Who is a TAX PAYER?

• Natural person – who earns taxable income

• If more than one person earns income in a joint craft occupation – everyone is liable for their share

• Heir – for all obligations arising from the realized income that the testator left before his death

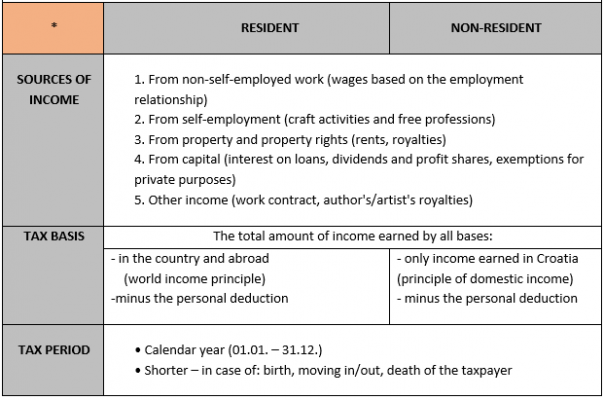

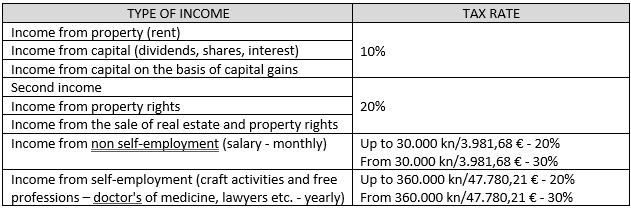

According to the above sources of income are:

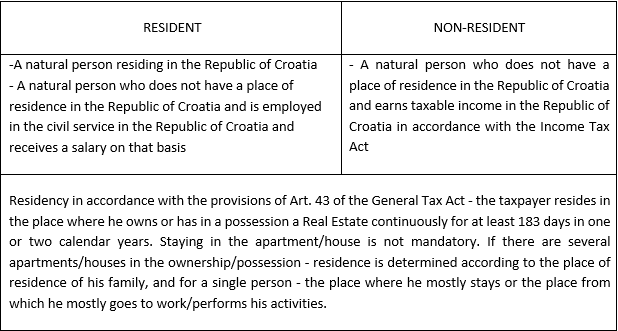

There are rules applicable for resident or non-resident income. But first of all let us determine who is who by the point of Law.

According to the General Tax Law (Official gazette 115/16 – 114/22):

Types of income and income tax rates

Currently, there are two rates of income tax applicable on wages earned by employment:

• for income up to HRK 30,000.00/3.981,68 € – 20%

• for income above HRK 30,000.00/3.981,68€ – 30%

Tax payers on income from non self-employment have the right to a reduction of the tax base by the amount of the basic personal deduction in the amount of HRK 4,000.00/ 530,90 €.

Author, Admin