Value added tax is a form of consumption taxation that was first introduced in 1958. in France and today it is applied in more than 170 countries around the world.

Who is a TAX PAYER?

Any person who independently performs any economic activity, regardless of the purpose and result of performing that activity.

What is a SUBJECT OF TAXATION?

• Delivery of goods in the country for a fee

• Providing services in the country for a fee

• Acquisition of goods within the EU for a fee

• Import of goods

What makes up the TAX BASE?

• for deliveries of goods/services in the country – tax base is compensation that the supplier received/should receive from the customer or some other person for these deliveries

• Acquisition of goods – purchase price of these or similar goods, or if this price is an unknown amount of costs determined at the time of delivery

• Import – customs value determined according to customs regulations.

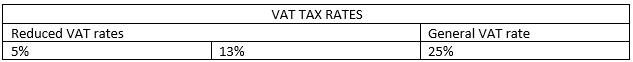

Pursuant to the amendments to the Value Added Tax Act (Official Gazette 113/22) as of October 1, 2022. a zero rate (0%) of VAT is also applied. This 0% is applied to the delivery and installation of solar panels that are installed on private residential buildings, residential premises and public and other buildings used for activities of public interest, as well as the delivery and installation of solar panels near such facilities, spaces and buildings.

Author, Admin